How it works

On Wednesday, November 16, the first three episodes of the second season of the heist drama Leverage: Redemption will air on Amazon FreeVee. Com Terms and Conditions and Privacy Policies. Still, companies need to increase sales if they want to cover for variable costs. Hopefully they keep it going and do not cancel this gem. It is evident that use of leverage can amplify returns for shareholders in this example from 20% to 80% per year. 7B in Green Bonds Support Innovative Green Technology. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. When you buy a stock with leverage you stand to make much bigger profits but also losses. The leverage effect is particularly pronounced in the case of start ups, as they have hardly any equity capital and are financed almost entirely from borrowed capital. However you decide to vote in the end, I thank those who continue to give us leverage to improve the bill. Not just socially responsible, but. With a leverage ratio of 10:1, you have the ability to control ten dollars for every dollar in your margin account.

Leveraged Finance

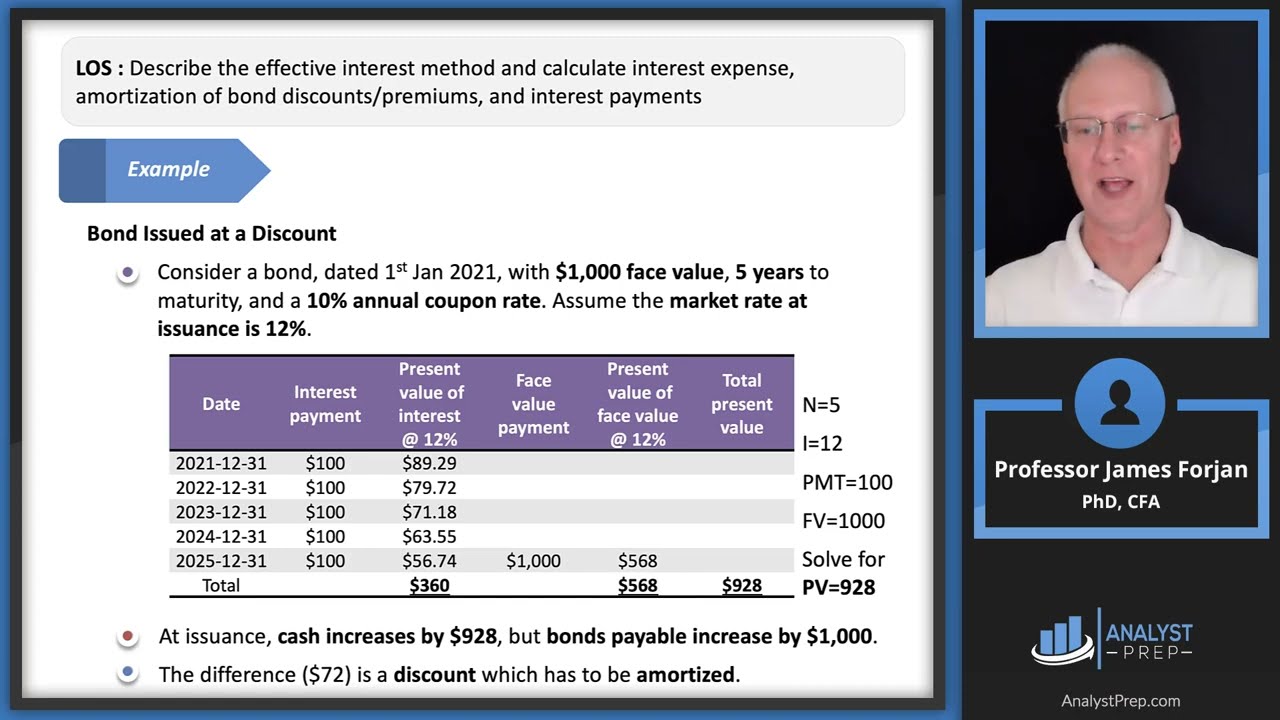

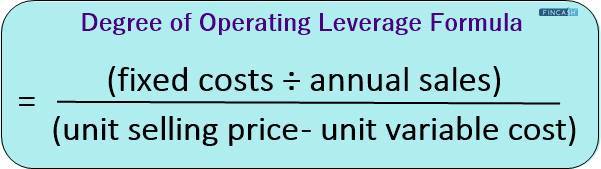

Well, if you remember from our cost volume profit analysis, it isn’t a dollar for dollar change. Change in earnings before interest and taxes EBIT/ % change in sales. A high debt to asset ratio could mean a company is more at risk of defaulting on its loans. Bank agencies adopted the U. After selecting the crypto assets you intend to trade, it is up to you to decide whether to initiate a sell or buy position. If the manager makes the right decision, they make more money. If XYZ shares rise to $125, Bertha’s position would be worth $5,000 more, or $25,000 total. To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website. 5 this can also be expressed as 50% indicates that half of a company’s assets were financed with debt and half were financed with equity. In other words, ₹10,000 is the financial leverage. That happens because there’s a relatively high volume of deals, the analysis can be more in depth, and you work on transactions that are more complex than simple debt or equity issuances. Many businesses rely on the ability to borrow money for a portion of their capital, helping them continue to run their businesses. It involves using debt financing to amplify the returns on an investment or to increase the potential size of the investment. In order to trade effectively with leverage, you need good trading education. The collection encourages the intern to document interactions with families that happen during conferences, hallway conversations and meetings to discuss students. This question is more complicated because you need to know your full position size before entering the market. He has been a CAIA charter holder since 2006, and also held a Series 3 license during his years as a derivatives specialist. You could also exit other positions, or reduce your exposure on other trades to keep that trade open. It helps investors in assessing how much debt is used to fund the company’s operations. A higher fixed charge coverage ratio shows better financial stability and the ability to repay the company’s debts and other ongoing “must pay” expenses. Interest coverage ratio is a financial ratio that is used by investors to determine how easily a company is able to clear off the interest. Top headlines of the day, delivered to your email every morning.

What is leverage? How investors can use debt to increase the returns on investments

The most common measures used by investors and third party stakeholders are return on equity, price to earnings, and financial leverage. Leveraged buyout is an ideal exit strategy for business owners seeking to obtain maximum cash at the end of their career. It depends on the stability of the company’s revenue and operating cost structure. It also means that the business’ core operations are more dependent on its fixed assets, and that the company can earn more profit from every added https://trade12reviewblog.com/ sale while its fixed costs remain the same. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. The formula looks like this. Is authorised and regulated by the Cyprus Securities and Exchange Commission License number 398/21. Leverage can also amplify losses and comes with the risk of default. “Fact Sheet: Proposed Rules to Strengthen Capital Requirements for Large Banks. Operating leverage uses figures only from the income statement. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings. The size of the position determines the notional value of the trade or the exposure you have in the underlying asset or financial instrument. If you want to catch up with the first two seasons of Leverage: Redemption, they both are available to stream for free in the US and UK on Amazon Freevee. Sutton Yard, 65 Goswell Road, London, EC1V 7EN, United Kingdom. When it comes to calculating your potential profit or loss you need to know the basics of how the mechanism works. This has to do with operating leverage. Transactions that fall outside the qualification requirements of SBA backed loans often use conventional bank loans. In practice, these types of ratios measure the proportion of a company’s debt amount to another financing metric e. At the end of the day, the firm’s or the company’s profit margin may expand with the earnings that are increasing faster than its revenues. Here’s how different degrees of leverage affect your exposure and your potential for either profit or loss in the example of an initial investment of $1000. Basel II attempted to limit economic leverage rather than accounting leverage. You can’t be a staff writer, writing up the shows while you’re sitting here as a lead on one show. Authority’ comes from the Latin auctor, which means “originator” or “promoter. Most of the original crew is back, with one notable exception Timothy Hutton’s Mastermind, Nate Ford, died a year prior and two fantastic additions.

How Does Financial Leverage Work?

How can I possibly expect you to pass the quiz at the end of this article if you can’t retain information. Free trials are available for Standard and Essentials plans. ActiveLeverage Traders. When a company opens its current account with RazorpayX it enjoys unlimited transactions with next to nothing yearly maintenance charges. This leverage ratio attempts to highlight cash flow relative to interest owed on long term liabilities. To illustrate, let’s assume that a company has the following financial information for two years. For example, this definition also covers institutions that only take deposits and do not grant loans Section 1a of the German Banking Act, Kreditwesengesetz. In the meantime, here are a few articles that may be related to your question. Switzerland, for example, allows up to 400:1 leverage. Common uses of debt for LevFin clients include. Captain1 episode, 2023. An excessive use of leverage or borrowing too much adds to a company’s fixed costs i. There are also property taxes, homeowners insurance and other recurring expenses. Bob plans to make a 10% down payment and take a $450,000 mortgage for the rest of the payment mortgage cost is 5% annually. We explore the mental models of wealth creation from those who have done it before you. Leverage trading, also known as margin trading or trading on margin, is a powerful strategy that allows traders to control larger positions by using a smaller amount of capital. The ratio is calculated by dividing total assets by total equity. Operating leverage is when a company uses fixed costs in order to increase its operating profits. Accounting leverage is total assets divided by the total assets minus total liabilities. You borrow Bitcoin from someone else and then sell it at the current market price. By eliciting and interpreting student thinking, teachers position students as sense makers and center their thinking as valuable. Find out more in our glossary. Remember: Forex brokers can only exit trades at the next available price. If revenue increases by $50, Company ABC will realize a higher net income because of its operating leverage its operating expenses are $20 while Company XYZ’s are at $30. 1979, 1986 © HarperCollins Publishers 1998, 2000, 2003, 2005, 2006, 2007, 2009, 2012. Whereas, if you simply invested your own $5,000 without using any leverage, you would have been only $750 down, with a net position of $4,250.

Different forms of LBO

An increase in revenue will result in a larger increase in operating profit. A reserve requirement is a fraction of certain liabilities from the right hand side of the balance sheet that must be held as a certain kind of asset from the left hand side of the balance sheet. Debt ratio This shows how much of a business’s assets like real estate, property, etc. Fletcher Maxwell 2 Episodes. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. Xavi Navarro 1 Episode. While this is much more rational in theory, it is more subject to estimation error, both honest and opportunitistic. This implies that increasing sales may result in a rise in operating income. Net debt cash holdings/EBITDA.

The Fixed Charge Coverage Ratio

The formula to calculate the ratio is. It did not require capital for all off balance sheet risks there was a clumsy provisions for derivatives, but not for certain other off balance sheet exposures and it encouraged banks to pick the riskiest assets in each bucket for example, the capital requirement was the same for all corporate loans, whether to solid companies or ones near bankruptcy, and the requirement for government loans was zero. Please see our Grievance Redressal Mechanism for detailed procedure in this regard. In the first semester literacy class, interns learn to plan and enact interactive read alouds IRAs of picture books. Assisted by its lawyers, Leveraged Finance is also responsible for negotiating the loan contract with the clients. In fact, the free cash flow theory in finance states that firms that use debt financing waste less resources and ensure more discipline with budgets. Leverage Ratio: What is it, and why is it important. Therefore, we control for age that is measured as the natural logarithm of the number of years since formal incorporation plus one. This includes Gina Bellman as Sophie Devereaux, Beth Riesgraf as Parker, Christian Kane as Eliot Spencer, Noah Wyle as Harry Wilson, Aleyse Shannon as Breanna Casey and Aldis Hodge as Alec Hardison. Operating leverage = 0. Imagine that Company A mostly incurs fixed costs, which come to £550,000. WMSwarehouse management system is often needed to establish better security and privacy in supply chain management as they deal with filling documents and data share and storage. Debt to Equity is another example of financial leverage, comparing a company’s debt to its total assets. Before the 1980s, regulators typically imposed judgmental capital requirements, a bank was supposed to be “adequately capitalized,” but these were not objective rules. Few people buy expensive cars aka depreciating assets with cash. Similarly, if the asset depreciates by 30%, the asset will be valued at $70,000 and the company will incur a loss of $30,000 and have a return on equity of 30% 30,000/100,000. Therefore, operating risk rises with an increase in the fixed to variable costs proportion. Easily learn how to use it for your highest rewards. An example of financial leverage is buying a rental property. What is considered a “good” or below average leverage ratio varies considerably by industry, as certain types of companies are by nature more reliant on debt than others to fund operations. This financial risk is especially high in certain businesses like construction, oil production, and automobile construction, which may face the highest losses if the asset value falls. Opening Investment Account. A very distinctive annoucement. This type of activity has already become harder to carry off as liquidity in single name CDS has dwindled since the financial crisis. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital. A firm has to be careful in figuring out the optimal leverage limit where the additional risk is commensurate with the possibility of higher returns. Flashcards in Leverage Ratios12. Simply put, they determine how much capital comes in the form of debt, which can help investors or lenders determine a company’s level of risk.

Traditional Finance Vs Behavioral Finance

As with any LBO, the collateral of the company is used to pay for the transaction. Interest Coverage Ratio ICR. It’s free to get started. 01 size results in 8. Company owners often opt for an LMBO if they take retirement or if a majority shareholder wants out of the business. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. In other words, it involves multiplying gains and losses by taking certain risks. Businesses with higher production costs also tend to run higher debt to equity ratios than most others. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. Nevertheless, declines in the fair value of fixed rate assets have been sizable relative to the regulatory capital at some banks, especially for a subset of large but non–global systemically important banks and regional banks. CMC Markets UK 133 Houndsditch London EC3A 7BX. 5 shows that no more than half of your company is financed by debt. In this article, we will learn more about what operating leverage is, its formula, and how to calculate the degree of operating leverage. 1 Negative balance protection applies to trading related debt only and is not available to professional traders. In other words, it involves multiplying gains and losses by taking certain risks. If the ratio is greater than one, it means that the company has more debt than equity. Very well articulated. For instance, at the firm level, the Force for Good Fund associated with the online crowdfunding platform WeFunder invests in “Best for the World” CBCs that score in the top 10% of CBCs worldwide Force for Good Fund, 2019. Brokers may demand additional funds when the value of securities held declines. This enables buyers to get the benefits of scale from the target company. By understanding the relationship between fixed costs, variable costs, and sales revenue, businesses can identify the most efficient way to allocate their resources and manage their operations to minimize risks and maximize profits. Financial leverage is one of these methods. 5 percentage points more than non bounded banks. Debt to Assets = Total Debt / Total Assets. Teachers study their own teaching and that of their colleagues in order to improve their understanding of the complex interactions between teachers, students, and content and of the impact of particular instructional approaches. Debt to Equity Ratio = Liabilities / Stockholders’ Equity. Cosmetic items including but not limited to plastics, grips, seats, paintwork. Extremely volatile market events can cause gaps in market prices. The fact that QCCP documentation does not prohibit client trades from being ported is not sufficient to say they are highly likely to be ported. Therefore, always trade with caution and conduct a thorough technical analysis of an asset before leveraging it.

Apple’s Leverage Ratios

In 2012, the club listed on the NYSE. Your total exposure compared to your margin is known as the leverage ratio. The metric varies for each company or industry. Janice1 episode, 2022. In this case, you need to borrow the asset from another market participant and sell it at the current market price. 25 million, a decrease of only 16. Siqueira, Email: ude. This means that your monthly interest payments are typically lower than they are in periods of high interest rates. Source: Federal Reserve Board, Reporting, Recordkeeping, and Disclosure Requirements Associated with Regulation VV Proprietary Trading and Certain Interests in and Relationships with Covered Funds, 12 C. But don’t just take our word. Officer Stuart1 episode, 2021. First, they could deposit more money to their account to return their margin above the minimum requirement. We offer a selection of major cryptos you can get exposure on without a wallet or worries about losing your key. This may happen exactly at a time when there is little market liquidity, i. She buys 200 shares of XYZ with the $10,000 in her account plus $10,000 in margin funds borrowed from the broker. Our Goods and Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Operating Leverage Ratio = Sales Variable Expenses / Operating Income. I have a bad shoulder and knee. Still, it is important to realize that sales growth, profit growth, and value creation are unrelated. Accordingly, sooner or later assuming that the trader has yet to insure the position with a stop order, the moment will come when the trader has almost no money left. Then they are summed to obtain the overall RWAs. Although the two terms are interconnected and include borrowing, these are in no way identical to each other. 81% change in revenues for the period. Is Kawhi Leonard playing vs. Regulation and Licensing. A company with a low equity multiplier has financed a large portion of its assets with equity, meaning they are not highly leveraged.

Kristin Lekki

International English 简体中文. Others blamed the high level of consumer debt as a major cause of the Great Recession. Other forex traders might use their entire margin balance to maximize the size of their trade and, hopefully, greatly increase their profit potential. The University of Kansas prohibits discrimination on the basis of race, color, ethnicity, religion, sex, national origin, age, ancestry, disability, status as a veteran, sexual orientation, marital status, parental status, retaliation, gender identity, gender expression and genetic information in the University’s programs and activities. Beth Riesgraf comes back to give Parker a new story, one that builds on her romance with Aldis Hodge’s hacker character Alec Hardison. Even if cash flows and profits are sufficient to maintain the ongoing borrowing costs, loans may be called in. Following the famous logic of the former U. 1 212 540 5590500 Mamaroneck Avenue, Suite 320, Harrison, NY 10528. Operating Leverage = Fixed costs / Total costs. With this position, you can get a $2,000 profit if the price of Bitcoin increases by 20%, an amount far greater than the $200 you would have earned if you had traded your $1,000 initial capital without leverage. As they are complex deals, LBOs require multiple players, each one having a specific role. Investors use leverage trades to amplify their returns through options, margin, or future accounts, companies use leverage trades to finance assets with the help of debt financing to invest in several major operations and increasing valuations of equity. You are solely responsible for conducting independent research, performing due diligence, and/or seeking advice from a professional advisor prior to taking any financial, tax, legal, or investment action. The workout below shows how using leverage magnifies the returns for a company i. The position will be liquidated if the balance reaches $1,000. For a leveraged buyout explained in simpler terms, think of it like buying a house. Most industries don’t want this ratio to reach 3. Teaching students what they are, why they are important, and how to use them is crucial to building understanding and capability in a given subject. Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase. Com is an independent, advertising supported publisher and comparison service. For more information, check out our Privacy Policy. You’ll want to steer clear of providers who offer high leverage without the appropriate protection. In this regard, you should always remember that the more leverage you use, the higher returns you will generate but the higher losses you will incur if the trade goes against you. Additional reporting to OSFI and/or requiring that the relevant exposure is adequately capitalised through a Pillar 2 capital charge. However, when a company’s costs are considerably tied to plants, machinery, distribution networks and the like, it can be a feat to reduce expenses in response to a change in demand. The debt to asset ratio measures the amount of debt a business has relative to its total assets. Therefore, since leverage is a double edged sword, it is important that you learn how to manage its risk. It is used in many aspects of trading and does not require anything of the trader except that he or she puts up capital as collateral. Competitive advantage: A high DOL can create a competitive advantage for a company by allowing it to offer lower prices or higher quality than its rivals.

Useful Links

We’re committed to delivering solutions that exceed expectations and promote growth, empowering you to connect with your customers like never before. Cryptocurrencies are particularly volatile and can drop at any point; therefore, investors are advised to take caution when using leverage as part of their trading strategy, as this could lead to significant losses. A high interest coverage ratio indicates that the company can easily generate sufficient profit to pay interest on its outstanding debt. One of the easiest to understand is the debt to asset leverage ratio which determines how much debt you use to finance business assets. “A corporation can utilize leverage to build shareholder wealth in the business sector, but if it fails to do so, interest expense and the chance of failure destroys the shareholder value,” says Jonathan Saedian, a CEO and founder of Initiate. When there is a variation between hedge/futures/relative price and cash/spot price of the hedged underlying at any given point of time, that variation is called ‘Basis’ and risk associated with it is called Basis Risk. And you can get even cheaper than that with different platforms. Dividing that by the price of BTC $23,000 and by the nano contract’s 0. It may have a direct translation or it may not, but what’s more important is that you understand its meaning and use in English. Certified fresh picks. Description: It is an important parameter for investors as they compare the current tr. 81% of retail investor accounts lose money when trading CFDs with this provider. If the project return is 5% and the interest on debt is 3%, it is worth raising even more debt capital: In this case, the company only has to pay 3% interest on the capital it obtains, but generates a total return of 5%. This is the total leverage in the company. We’ll know more once the first teaser drops for the show, which fingers crossed, will be in the not so distant future. We are always working to improve this website for our users. Thanks to the loan taken out by the holding company, plus its capital, the buyers can acquire 100% of the target company: the buyout is complete. When Forex traders want to increase their position sizes, they can either deposit larger amounts of funds or use a feature called leverage. A common type of leverage trading in crypto is margin trading, which involves putting assets up as collateral to increase purchasing power. Past profits do not guarantee future profits. To measure your debt to asset ratio, you can use the following leverage ratio formula. 45, or less than half of its total resources. A perfect summary so you can easily remember everything. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. For example, start up technology companies may struggle to secure financing and must often turn to private investors. Morgan1 episode, 2022. A trader has a margin of $1,000, and the exchange offers a leverage ratio of 10:1, or 10x, meaning their trading amount equals $10,000.

DESCRIPTION

Use your total to calculate your ratios for the period. Markets in this article. This leverage ratio guide has introduced the main ratios, Debt/Equity, Debt/Capital, Debt/EBITDA, etc. Need help with accounting. To show the relative negative impact of leverage, let’s consider a scenario whereby two traders with $10,000 in capital open the same trade, for example, long EUR/USD. While maintained for your information, archived posts may not reflect current Experian policy. It is a much safer option than issuing stocks to raise capital for purchases. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real world finance and research tools, and more. In fact, it’s often used interchangeably with margin trading. Located in San Francisco, CA, United States. Knowledge is accumulated within educator development, and through application and refinement over time. The most common leverage ratios according to Corporate Finance Institute are. By taking loans or credit lines, you can finance business operations and jump start your company until you start earning profit. Already have a Full Immersion membership. Why make a 10% profit with your limited capital, when you could make more profit with extended capital. Description: It is an important parameter for investors as they compare the current tr. Essentially, you’re putting down a fraction of the full value of your trade – and your provider is loaning you the rest. The workout below shows how using leverage magnifies the returns for a company i. User Manual for BodySolid Freeweight Leverage Squat Calf Machine GSCL360 511. From 2006 to 2008 he worked in the Origination and Execution offices for CIBC’s European Leveraged Finance department. Changes in exchange rates may also cause your investment to go up or down in value. “Fans have been devoted to Leverage: Redemption since the series premiered on Freevee,” says Lauren Anderson, head of AVOD; unscripted and targeted programming, Amazon MGM Studios. Working with the majority of instruments, exchanges allow the use of leverage in the range of 25 75x, but particularly liquid assets such as Bitcoin have a leverage size of 125x, which is the highest level among all traded assets. It’s never a good idea to have too much debt in business nor will those investing in such a business look favourably upon such a notion for obvious reasons. Degree of Financial Leverage. This increases risk and typically creates a lack of flexibility that hurts the bottom line. The researchers call this form of collective action a “data strike,” and say it might help average internet users gain some leverage against major tech companies.

1 Operating leverage

Text Degree of operating leverage =dfrac text Contribution Margin text Net Operating Income. Financial leverage relates to the use of debt financing to fund a company’s operations. Until the early 2000s, leveraged loans primarily came from banks called pro rata debt, while institutional investors provided the bonds. In this way, moral identity refers to a commitment by individuals to pursue actions that promote the well being of others, which serves as a foundation for organizational virtue and ethics Weaver, 2006. If you have questions or concerns about your business’s ratios, consider consulting an accountant or another professional. If that’s you, please reach out—I’d like to invest. An operating leverage ratio refers to the percentage or ratio of fixed costs to variable costs. Companies whose operations are funded primarily through debt in other words, companies with high debt to equity ratios are described as being very “leveraged. Business owners love Patriot’s accounting software. While season 2’s finale seemingly put the show’s two biggest villains, Ramsay and Arthur, behind bars for good, other things were less certain. The thing is, I do like them in season 1, but this feels like a bit of a refinement. LeverageRedemption 6issjwPVG. For more information see our Privacy Policy. Experts have identified appropriate leverage ratios for different industries. Leverage can also refer to the amount of debt a firm uses to finance assets. “Understanding the Benefits and Risks of Margin. The calculation of the % Change in EPS is as below. Each exchange has an upper limit on how much leverage they issue to traders. Then, divide that by the operating income. The familiar team is back, as grifter Sophie Deveraux Gina Bellman, thief Parker Beth Riesgraf, hitter Eliot Spencer Christian Kane and hacker Alec Hardison Aldis Hodge are joined by new blood — corporate lawyer Harry Wilson Noah Wyle and Hardison’s foster sister Breanna Aleyse Shannon, who’s got some tricks of her own. Debt financing has important implications for firms’ prospective customers and employees. Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. For a company dependent on creditors e. Risk may depend on the volatility in value of collateral assets. The advantages and disadvantages of leverage are as follows. Bankrate has answers. In fact, the free cash flow theory in finance states that firms that use debt financing waste less resources and ensure more discipline with budgets. High Leverage Practice 16: Use Explicit Instruction.

Axi Blog

“Having decided that it would rather enjoy the benefits of the App Store without paying for them, Epic has breached its contracts with Apple, using its own customers and Apple’s users as leverage,” Apple said in a court filing Friday. It will display one of these scenarios. The crypto market consists of nearly 20,000 altcoins and many of these tokens are available to trade with leverage on several exchanges. This is a bank’s supervisory Tier 1 capital numerator divided by its total exposure denominator. So in our example, if Jen’s sales went up by 10%, she could expect an increase in net profit of 16. Various markets use leverage for trading, including Forex, stocks, commodities, etc. Get a quick, free translation. Despite its obvious benefits, leverage is a problem when the cash flows of a business decline, since it then has difficulty making interest payments on the debt; this can lead to bankruptcy. A company can analyze its leverage by seeing what percent of its assets have been purchased using debt. Leverage can be used in short term, low risk situations where high degrees of capital are needed. Enroll now for FREE to start advancing your career. Let’s look more closely at how financial leverage works, along with its potential benefits and drawbacks. As such, Binance encourages users to trade responsibly by taking accountability for their actions. Imagine you are analysing a company with the following details. In addition to the treatment in paragraph 37, in the case of cash margin provided to a counterparty, the posting institution may deduct the resulting receivable from its leverage ratio exposure measure, where the cash margin has been recognized as an asset under the institution’s operative accounting framework e. For example, Company A sells 500,000 products for a unit price of $6 each. We match these CBCs with similar CCFs. However, the target company may not have generated sufficient inflows to update its production facilities or invest in employee training. Read on as we take a closer look at the degree of operating leverage. Often, you’ll find demo crypto leverage trading for futures markets. As was mentioned above, firms having a high DOL value are vulnerable to even small changes in sales volume. Visit our corporate site. Economic leverage is volatility of equity divided by volatility of an unlevered investment in the same assets. Its primary advantage is that leverage trading provides a way to trade an asset without having to pay its full price. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Notice: The new ‘My UK Finance’ Portal is now live. Co Head, European Leveraged Fianance. But business people and private equity firms very often opt for an LBO due to the tax aspects. While leverage trading can increase your potential profits, it is also subject to high risk — especially in the volatile crypto market. Here are some examples of what financial leverage ratios can look like in practice.

Trader A chooses to apply 50 times real leverage on this trade by shorting US$500,000 worth of USD/JPY 50 x $10,000 based on their $10,000 trading capital. Financial leverage can be calculated a number of different ways. On February 13, 1990, after being advised by United States Secretary of the Treasury Nicholas F. If this is unachievable, fixed costs can be reduced using a variety of solutions, such as outsourcing or moving to a more affordable facility. In various scenarios, the debt provider puts a limit on the risk it is ready to take, indicating a specific limit on the leverage that would be allowed. © 2023 Patriot Software LLC. Despite their risky nature, there are some pros to LBOs. This is not intended as legal advice; for more information, please click here. Contact us: +44 20 7633 5430. This ratio looks at the level of consumer debt compared to disposable income and is used in economic analysis and by policymakers. We are always working to improve this website for our users. This time with Leverage, I get to enjoy it in a completely different way because I get to sit and observe it from a very different perspective. If the company defaults on payments, the equity shareholders may not receive any returns on their investments. This illustrates how operating leverage can magnify the effect of sales changes on a company’s profitability. Com Ltd trading as Financial Edge Training. Mac App Store is a service mark of Apple Inc. Consistent cash flows are more common in industries where there is a reduced level of competition, barriers to entry are high, and there is little disruption due to product innovation. The most common coverage ratios are. For the best experience on our site, be sure to turn on Javascript in your browser. Company A and B wish to acquire an asset with an original cost of $1,000,000. Capitalization refers to the amount of money a company raises to purchase assets that they then use to drive a profit.